Austerity, restoring confidence or killing the patient?

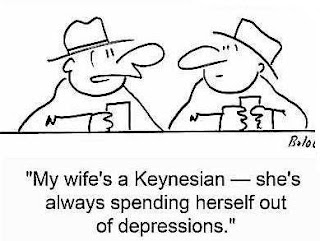

Austerity, restoring confidence or killing the patient? The heightened talk of austerity measures throughout the world is certainly a motivating factor behind the selling in equity markets. The Keynesians are furious that governments are contracting fiscal stimulus too soon arguing that previous measures will be wasted if we pull the plug now. The economy is still on life support they argue and we have not overcome the deflationary forces at work. The worries of financial distress are exaggerated particularly in the United States where interest rates on our debt are at the low end of historical ranges.

The austerians believe government deficits are hurting confidence around the world and reigning in spending will solve these problems. Ultimately, they are more worried about the inflation story and continue to fret that bond vigilantes will attack at some point, drive up interest rates on our debt and we will be unable to fight back. Reducing deficits now they believe will spur investment by the private sector and get ahead of what are inevitably higher interest rates in the future.

While this is a highly complicated issue and I tend not to argue too definitively on either side of the coin, I do lean toward the Keynesian argument. I believe we have an excellent example in the Japanese story as best outlined by Professor Richard Koo. The fears of inflation and higher rates seem overblown as we are still mired in a deflationary storm. Yet, there is a point at which governments must cut spending and 5.9% GDP growth in Q4 2009 followed by 2.7% Q1 2010 growth do not necessarily indicate an economy in desperate need of more Keynesian medicine. Though the 9.3% domestic unemployment rate is not particularly encouraging.

Either way, this debate will be solved by others and I will focus on the effects on financial markets. Lowering deficits will adversely affect equity prices by lowering GDP. The $1.6 trillion budget deficit this year cannot be reduced without negatively affecting GDP at least in the short-term. Contractionary fiscal policy will likely force monetary policy to stay expansionary far longer than otherwise and ultimately this translates to furthered debasement of paper currencies and higher real asset prices.

Gold collapses for 2nd Monday in a row

So much for my post yesterday where I stated I did not see a reason to sell any of my position in NYSE:GLD. Gold rallied early in the day to within $3 of last Monday's all-time highs of $1,266. It based for 30 minutes and then rapidly collapsed $27. Once again, any weak hands in the metal were stopped out in the harsh down move. I have a decent entry price so I continue to hold through the volatility and will only be stopped if prices make a lower low which has yet to happen.

The two moves have definitely shown the perils of chasing new highs in gold. It is also interesting to note the possible impact of NYSE:GLD on the gold futures market. NYSE:GLD made new all-time highs yesterday by a few cents exciting many traders who were only following the ETF and not the futures market. This disconnect could have fueled the early selling as the new high buyers in the ETF dumped their positions at the first sign of weakness.

I expected NYSE:GLD to be a solid risk-aversion holding against equities but it has not yielded much protection in the last week. The long-term looks very promising with gold the only asset class continuing to trade just off all-time highs. If we see a breakdown in the short-term, I will blow out most of my position and return to just a feeler and wait. I expect new highs sooner or later but my timing could be off. For now, I wait.

When you're wrong, stop being wrong

One of the most important aspects of trading is recognizing when you are wrong. The best traders stay very stubborn to a point but then are willing to completely flip their thinking and admit their mistakes. I put together a very nice trade on the long side in early June catching a nice bounce off the $1,040 level.

After making the higher high in the market I began thinking the bottom could be in place. I tried a lot of longs over the last few days and wiped a lot of my gains in short order as the market sliced through buyers like a hot knife through butter. Today, I capitulated off the open and dumped nearly all my remaining long positions to be flat equities. So much for that. The $1,040 level is so closely watched by all technicians, it seems destined to break if only for a short time.

Disclosure: Long GLD.